The Bloomberg Barclays US Aggregate Bond Index posted a solid total return of 2.9% in the second quarter of 2020, its eighth consecutive quarterly gain, and a relatively strong quarter for the broad investment-grade bond index considering the outsized stock market gains over the quarter.

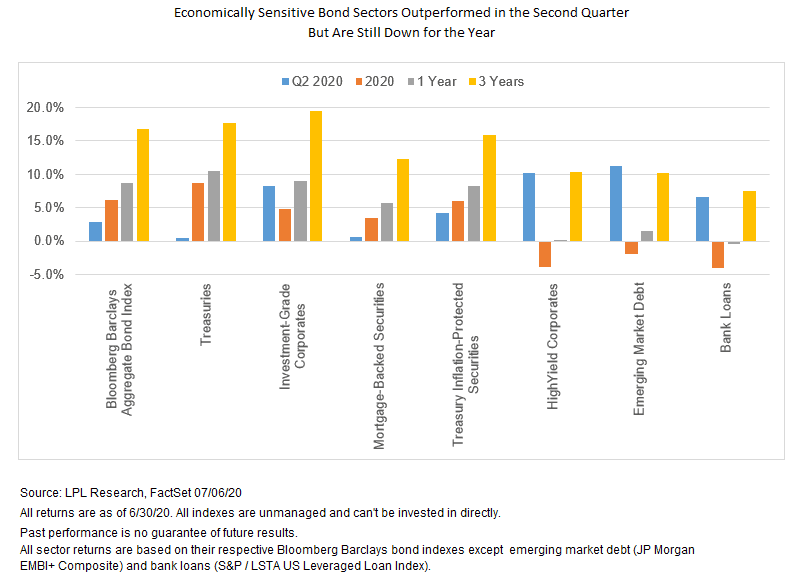

The index is up slightly more than 17% over those eight quarters, the best two-year stretch since 2010. As shown in the LPL Chart of the Day, more economically sensitive sectors (high-yield corporates, bank loans, emerging market debt) led in the second quarter of 2020, but even Treasuries advanced and investment-grade corporate bonds held their own, nearly keeping up with high-yield corporates, as the Federal Reserve added the sector to its bond purchase program.

“Fixed income has had a great run, whether you look back two years or 20,” said LPL Financial Chief Investment Officer Burt White. “But the road may get tougher going forward. Bonds still have an important role to play in a diversified portfolio, but finding good sources of income while managing risk is probably going to get more challenging.”

Despite their second-quarter success, the more economically sensitive sectors are still down for 2020 and continue to lag the higher quality Bloomberg Barclays Aggregate over both one- and three-year periods. That might give them more room to run, but any short-term economic weakness could substantially raise the risk of default. As a result, we generally remain cautious.

Momentum continues to favor investment grade bonds. If you look only at the price return for the Bloomberg Barclays Aggregate Bond Index, the last eight quarters have been its best two-year stretch since 1987, a span of over 30 years, reflecting the dramatic decline in already low interest rates over the period. Even in an extended era of falling rates, what we’ve seen over the last two years has been unusual. Returns for quality bonds may be limited in the near term given the current low rate environment and strong two-year returns, although quality bonds will continue to be supported by Federal Reserve policy and expectations for economic slowdown, both of which will help limit any move higher in rates.

While mortgage-backed securities (MBS) have lagged in the investment-grade space over several lookback periods, where the preference for Treasuries during periods of volatility has shown its value over the last several years, we believe there may be reason to favor MBS looking forward. They provide greater protection if interest rates should rise than Treasuries do, generate income that does not lag all that far behind investment-grade corporates, and Federal Reserve buying has not yet supported pricing to the degree it has during past periods of quantitative easing.

Treasuries tend to be the best defense against declining stock markets and investment-grade corporates generate higher income and can benefit from their economic sensitivity, but an emphasis on MBS may have the best balance of risk and reward as the global economy continues to work its way out of recession.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All market and index data comes from FactSet and MarketWatch.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

A mortgage-backed security (MBS) is a type of asset-backed security that is secured by a mortgage, or more commonly a collection (“pool”) of sometimes hundreds of mortgages. The mortgages are sold to a financial institution (a government agency or investment bank) that “securitizes”, or packages, the loans together into a security that can be sold to investors. The structure of the MBS may be known as “pass-through”, where the interest and principal payments from the borrower or homebuyer pass through it to the MBS holder, or it may be more complex, made up of a pool of other MBSs.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05030267