Market Blog

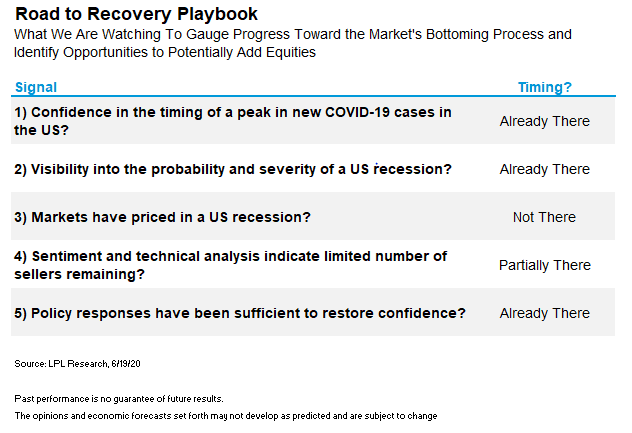

The US economy has made impressive progress in recent weeks. As the economy re-opens, the way we assess the recovery has changed. In March and April, we were looking for evidence that growth in COVID-19 cases was decelerating—which thankfully it did—along with evidence that a recession was priced into stocks and that stimulus measures were sufficient to get us through the crisis. We used our Road to Recovery Playbook, shown below, to help us determine how the market was progressing in its bottoming process.

Using this framework, stocks are clearly no longer pricing in a recession (#3); in fact, the recession in the United States is probably already over, and stocks are trading at their highest next 12 month’s price-to-earnings ratios (PE) since the tech bubble 20 years ago. In addition, we no longer have widespread investor pessimism that could potentially translate into outsized gains (signal #4).

But we do think we know what the COVID-19 peak looks like (signal #1), though we acknowledge the crisis isn’t over. We have also seen how deep the recession is (signal #2), while the policy response has been massive and sufficient to enable the recovery (signal #5).

“We are encouraged by recent progress in reopening the economy, but it’s been low-hanging fruit,” according to LPL Equity Strategist Jeffrey Buchbinder. “As the pace of the economic comeback eventually slows in the second half, investors may stop celebrating strong growth rates and turn their focus to the shortfalls versus pre-pandemic activity, which could create a tougher path for stocks.”

So what now? As we wait for stocks to digest these strong gains over the past three months, we need new tools to gauge the next phase of the recovery. We gave you a taste of those new tools here last week, which include some of the timeliest, high-frequency data to assess the economic reopening.

For stocks to move much higher from here, we believe we will need continued steady improvement in economic activity in the daily and weekly data. In such a dynamic and uncertain economy, most monthly and quarterly economic reports are stale by the time they are released. Look for more updates on these timely data points in the weeks ahead.

For more on the reopening, please listen to our latest LPL Market Signals podcast here.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: A higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05025254